Fundraising can take place at different stages in a company’s life: at its inception, during its growth, when it is floated on the stock exchange, or when there is an ownership change that brings in funds in order, for example, expand the company. When raising funds, the company’s value is assessed and negotiated. Thus, the incoming investors will pay each share at the current and not the initial price, called the nominal value, of the company. The difference between the current and nominal (previous round) values is called the share premium.

For innovative and technological start-ups, access to bank loans is difficult as they do not have a consolidated turnover: these start-ups are a risk for banks. Therefore, they call on investors to obtain funds: this is fundraising. As they are considered to have a high development potential, these start-ups potentially offer a high return on investment and therefore attract investors.

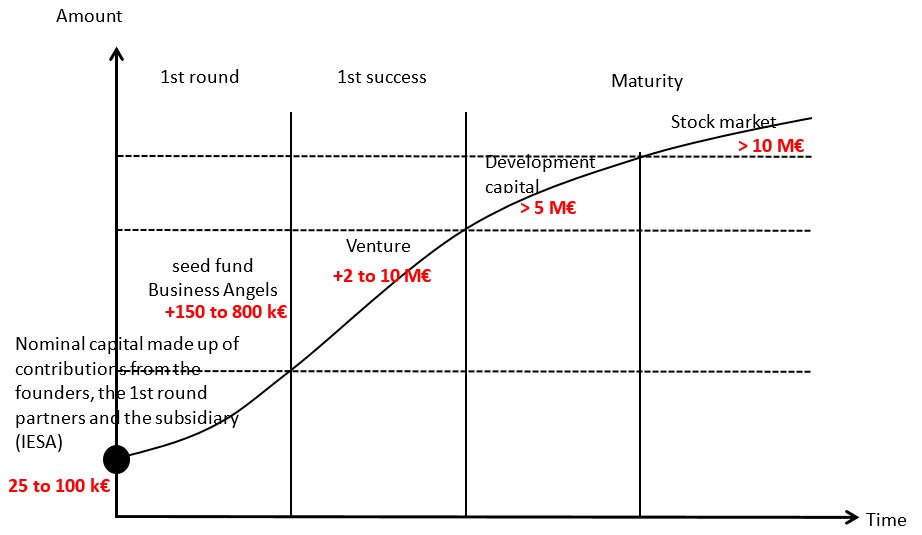

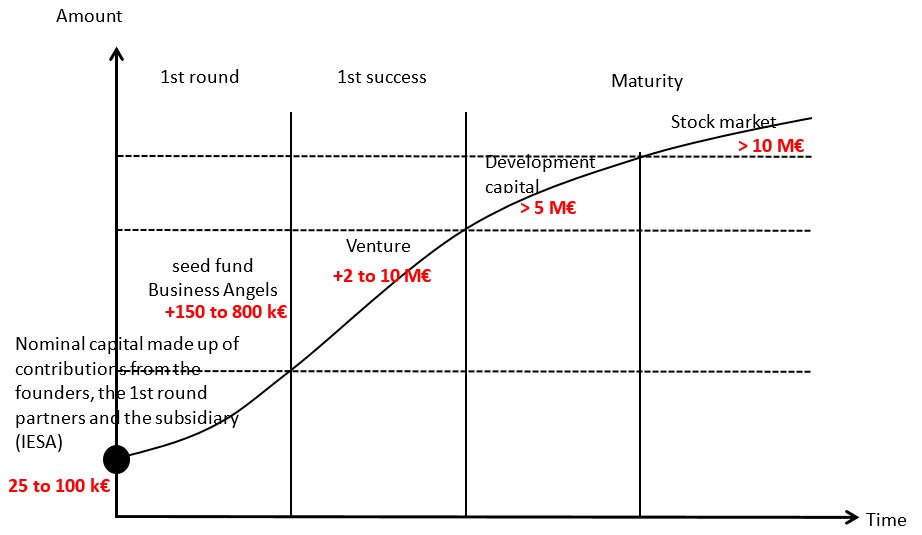

The amount of fundraising and the type of investor depend on the maturity of the company as shown in the graph below:

When the company is set up, the founders' initial contributions constitute the so-called "nominal" capital. The founders are the creators, possibly partners from the outset, and companies taking shares in the nominal capital, such as the INPG subsidiary Entreprise SA.

Then come the

seed funds and/or

Business Angels (BA) who invest in the first round. This is the first capital contribution in a company after its creation. For this first round of funding, the value of the company will have to be evaluated in order to determine the distribution of the capital increased between the initial founders and the new entrants for their contribution from the seed funds. The BAs are individuals who invest their personal money and put their expertise and network at the service of the companies they invest in on a voluntary basis. Average entry tickets for this first round are between €150 and €800k.

Then come the venture capital and development capital funds. These two types of investment funds select companies on several criteria. Most of them are specialised by industry and by maturity stage.

Venture capitalists intervene when the company has not yet reached maturity in terms of turnover in relation to its capacity to secure additional market share in its business area.

Venture capital funds invest between €2 and €10 million.

Development capital funds finance mature companies, created several years earlier, with bright growth prospects. They invest amounts in excess of €5m. Fundraising can be used to buy out competitors in order to increase market share or to finance an initial public offering (IPO), allowing the company to be listed on the Stock Market and continue to raise funds.

All these operations require high levels of financing.

Do you want to create your start-up and have questions about its financing?

Contact

Henri-Marc Michaud, Chairman of INPG ENTREPRISE SA Management Board

Examples of fundraising

The Vulkam

start-up, the result of research

valorisation carried out at the Science and Engineering of Materials and Processes (Science et Ingénierie des Matériaux et Procédés, SIMaP) laboratory, has

raised €4.5 million from four investment funds and Bpifrance's Deeptech programme: a very good example of

cera virtuous circle of research valorization!

•

More about Vulkam’s fundraising: Press release (.pdf - in French)

•

More about Vulkam

The start-up MagIA Diagnostics has raised €1 million to develop a new generation of blood tests that will simplify the detection of infectious diseases. It is a breakthrough innovation stemming from the intersection of micro-magnetism and biology.

The start-up MagIA Diagnostics was created from the development of a portfolio of industrial property assets held by Grenoble's public institutions, including Grenoble INP.

•

More about fundraising by MagIA Diagnostics: Press-release (.pdf - in French)

•

More about MagIA Diagnostics

Congratulations to the teams!

Written by Henri-Marc Michaud, Isabelle Chéry and Gaëlle Calvary